3D Secure Authentication

Learn how 3DS authentication prevents you from fraud transactions.

3D Secure authentication, also known as 3DS, is a security protocol designed to protect online card transactions from fraud. It is a globally recognized standard that was first introduced by Visa and has since been adopted by other card networks such as Mastercard and American Express.

Visa Secure & Mastercard ID Check

The aim of 3D Secure authentication is to prevent fraudulent transactions by adding an additional layer of security to online card payments. By doing so, it helps merchants to reduce the risk of fraudulent transactions and chargebacks, which can lead to significant financial losses.

How 3D authentication prevents merchant fraud transactions

The 3D Secure authentication process involves a series of steps that require the cardholder to verify their identity before completing a transaction. This verification is typically done through a one-time password (OTP) that is sent to the cardholder's registered mobile number or email address.

Once the cardholder enters the OTP, the issuer can verify that the transaction is genuine and authorize it. By using 3D Secure authentication, merchants can prevent fraudulent transactions as it is difficult for fraudsters to obtain the OTP, which is needed to complete the transaction.

In addition, if a fraudulent transaction does occur, merchants can dispute the chargeback by providing evidence that the transaction was authorized using 3D Secure authentication.

The difference between 3DS 1.0 and 3DS 2.0

The main difference between 3DS 1.0 and 3DS 2.0 is the level of security and the user experience they provide.

3DS 1.0 relied on a static password system, where the user would enter a pre-defined password to authenticate their identity during a transaction. This method was sometimes inconvenient for users, and it was susceptible to fraud attempts.

3DS 2.0, on the other hand, uses more advanced authentication methods, including biometric authentication and device recognition. This version also includes new features, such as risk-based authentication, which allows issuers to determine the level of authentication needed based on the risk level of the transaction.

Unless the issuing bank only supports 3DS 1.0, EVONET always provides the 3DS 2.0 solution which offers a more secure and streamlined authentication process for online transactions, improving both the security and user experience compared to 3DS 1.0.

Benefits of enabling 3D Secure authentication

Enabling 3DS authentication can be an effective way to improve the security and reliability of online transactions, protect against fraud, and build customer trust. It provides several benefits to both merchants and consumers, including:

Increased security

3DS authentication adds an extra layer of security to online transactions by requiring customers to authenticate their identity using a one-time password or biometric authentication. This can help prevent fraudulent transactions and reduce chargebacks for merchants.

Reduced liability

By using 3DS authentication, merchants can shift liability for fraudulent transactions to the card issuer or the customer's bank, which can help reduce the financial burden on the merchant in case of fraudulent activity.

Improved customer confidence

By providing a more secure checkout experience, merchants can improve customer confidence in their brand and encourage repeat business.

Compliance with regulations

In some regions, such as the European Union, 3DS authentication is required for certain types of transactions in order to comply with regulations like PSD2 (Payment Services Directive 2).

Better fraud management

3DS authentication can provide merchants with additional data and tools to help them manage fraud risk and identify suspicious transactions.

How to implement 3D Secure transaction

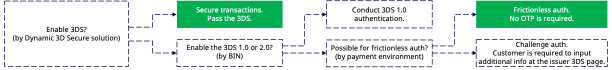

Our Dynamic 3D Secure service can be configured according to pre-set rules to help you determine whether to conduct 3DS authentication for transactions.

Through pre-positioned data comparison and verification logic, our dynamic 3DS service helps you greatly optimize the customer experience.

Our dynamic 3DS service is currently available in both API Integration and LinkPay Integration.

Dynamic 3D Secure service

Updated 9 months ago